You focus on growth. We'll handle the tax, FX, and compliance.

Astrovia automates the complex, from cross-border tax filings to FX optimisation, so your Shopify brand scales profitably and compliantly across 200+ markets.

We manage global tax, duties, and compliance for Shopify brands. Automatically, across every market.

Real-time VAT, GST, IOSS, nexus, and profitability intelligence as you scale internationally.

This globe shows Earth's actual proportions. Africa appears large because it truly is - larger than the USA, China, India, and Europe combined. Traditional flat maps (Mercator) distort sizes, making equatorial regions appear smaller.

A unified system of record for global tax, compliance, and profitability.

Astrovia automates the complex, from cross-border tax filings to FX optimisation, so your Shopify brand scales profitably and compliantly across 200+ markets.

Shopify-native development meets international tax expertise to optimise every layer of your eCommerce operation.

Deep Shopify integration, multi-store management, automated HS code classification, and real-time VAT audit trails.

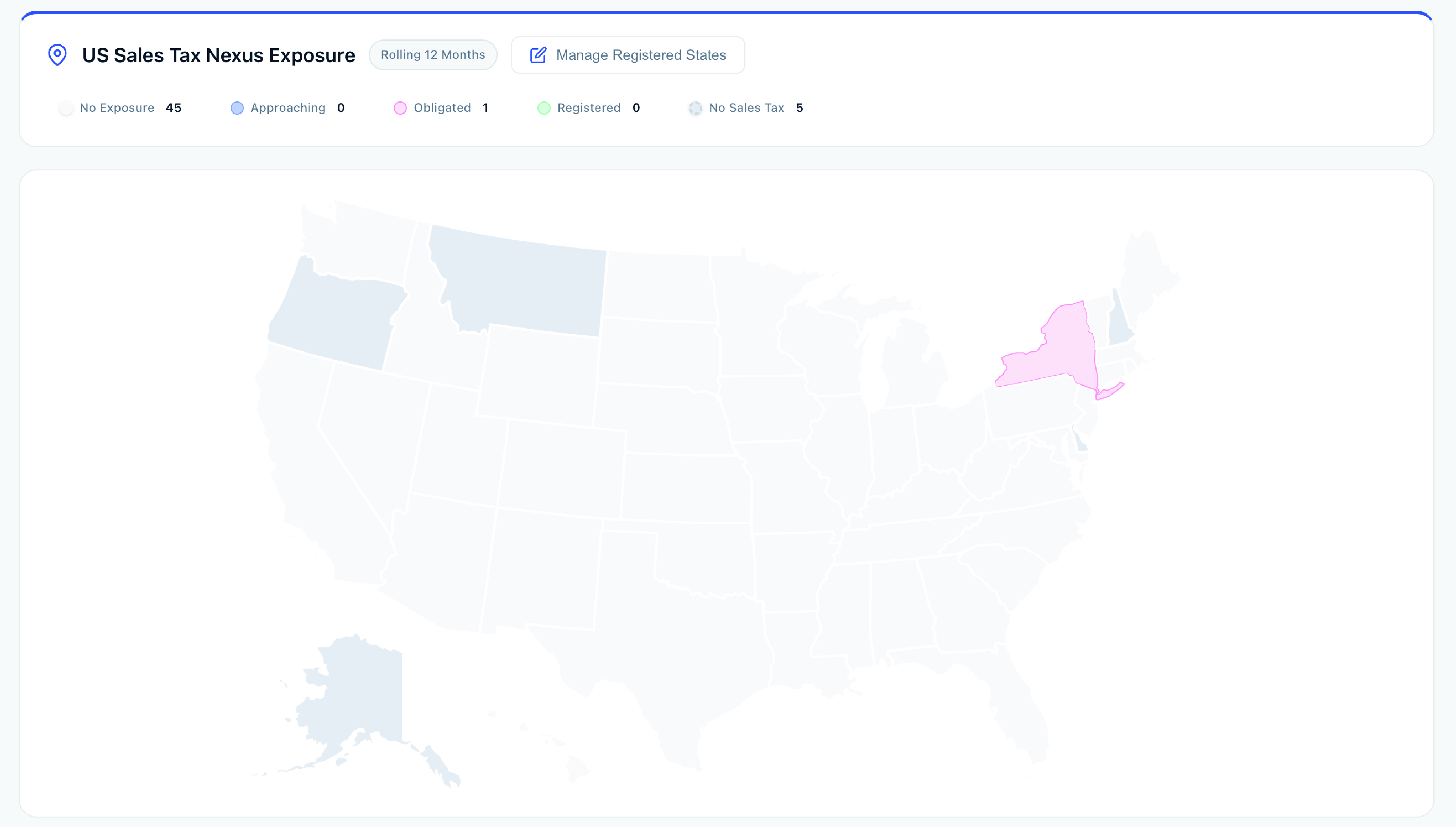

IOSS and VAT filing, US nexus compliance, GST/HST management, and complete compliance setup across 200+ jurisdictions.

Strategic tax reduction, FX fee optimisation, global cost modelling, and entity structuring for maximum margins.

Real outcomes from strategic implementations.

Enabled compliant UK VAT registration, reclaim, and remittance while implementing landed-cost checkout via Shopify Markets. Improved compliance, reduced import tax leakage, and increased conversion through transparent pricing.

Restructured U.S. import flows for high-volume Australian brands by implementing a compliant U.S. LLC and B2BC model. Goods transferred at arm's-length manufacturing cost to materially reduce tariff exposure across U.S.-bound shipments.

Designed and implemented compliant B2BC import structures for growing Australian brands shipping into the U.S. Reduced tariff exposure while maintaining defensible transfer pricing and customs compliance.

Mapped SKUs by destination country and automated HS code selection using Shopify metafields. Reduced average duty rates across thousands of monthly shipments through correct classification and jurisdiction-specific logic.

Implemented compliant B2BC import models using U.S. entities, enabling goods to enter the U.S. at manufacturing cost (arm's-length). Significantly reduced tariff exposure while maintaining customs and transfer-pricing defensibility.

Designed end-to-end international expansion frameworks covering the U.S., UK, and EU. Managed VAT registration, IOSS setup, and ongoing remittance while aligning Shopify Markets, landed-cost logic, and compliance workflows.

From Shopify data to global tax clarity in one unified system.

Authenticate via Shopify and sync orders, catalog, and tax settings in minutes.

Harmonise VAT, GST, duties, and thresholds across all jurisdictions automatically.

Dashboards surface filings, anomalies, and jurisdiction status in real time.

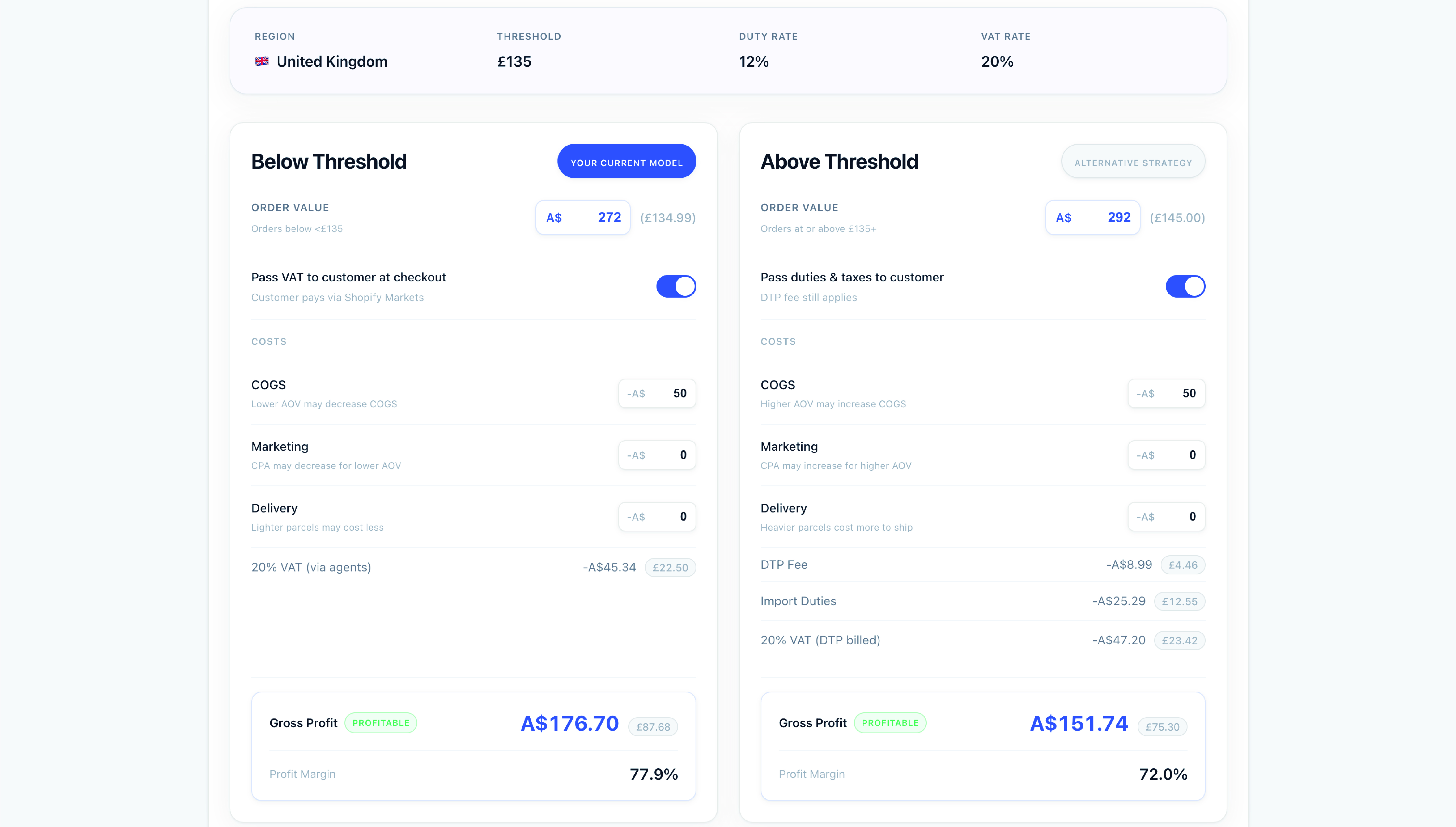

Model scenarios to quantify margin impact before you execute any decision.

Clarity across every layer of your global operation.

Search any market to see tax thresholds, VAT rates, and compliance requirements.

Tax thresholds change frequently. Verify with official sources before making business decisions.

The B2BC model uses a local U.S. entity to import inventory, reducing per-order duties and unlocking the $800 de minimis threshold for outbound shipments.

Compare your current FX spread against optimized rates. Most merchants overpay by 1-3% on every international transaction.

Built for finance and compliance teams.

Audit-ready by default.

AES-256 encryption at rest and in transit across all systems.

Audited infrastructure with documented controls and monitoring.

Granular permissions with full audit trails for every action.

GDPR and CCPA aligned data handling and retention policies.

Access to a complete operating system.

No feature gates. No artificial limits.

Full data mapping, profitability analysis, and compliance reporting across core markets.

Complete system access including the Customs Intelligence Engine, advanced reporting, and priority support.

End-to-end tax, customs, and compliance operations including duty reduction strategies, multi-region entity structuring, VAT/GST/IOSS management, and ongoing optimisation across global markets.

We'll respond within one business day.

Last updated: December 2024

ASTROVIA PTY LTD (ABN 71 688 000 768) ("Astrovia", "we", "us", "our") is committed to protecting your privacy and handling personal information in a transparent, secure, and responsible manner.

This Privacy Policy explains how we collect, use, disclose, and safeguard personal information when you access or use the Astrovia platform, applications, websites, and related services (collectively, the "Services").

Astrovia primarily provides services to businesses; however, this policy applies to all personal information processed in connection with the Services.

Registered Address:

ASTROVIA PTY LTD

The Commons, Level 1

55 Collins Street

Melbourne VIC 3000

Australia

Information you provide directly:

Information collected automatically:

We use information collected to:

Where applicable, processing is based on contractual necessity, legitimate interests, or legal obligations.

Astrovia does not use customer data to train public AI models and does not resell personal information.

We may share information with:

We do not sell personal information.

We implement commercially reasonable security measures, including:

No system is 100% secure, and we cannot guarantee absolute security.

We retain information only for as long as necessary to provide Services, comply with legal obligations, resolve disputes, and enforce agreements.

Depending on your jurisdiction (including Australia, the UK, EU, and other regions), you may have rights to:

Requests can be made via hello@astrovia.io.

Your information may be processed in jurisdictions outside Australia. Where required, appropriate safeguards such as standard contractual clauses or equivalent mechanisms are implemented.

We use cookies to operate the platform, analyse usage, and improve performance. You may control cookies via your browser settings.

We may update this Privacy Policy from time to time. Changes will be posted on our website with an updated "Last updated" date.

For privacy enquiries: hello@astrovia.io

Last updated: December 2024

These Terms of Service ("Terms") govern your access to and use of the Astrovia platform and Services.

By using the Services, you agree to be bound by these Terms. If you do not agree, you must not use the Services.

Astrovia provides a software platform and managed coordination tools designed to assist eCommerce businesses with:

Astrovia integrates with third-party platforms and service providers.

Astrovia does not act as a statutory tax agent, customs broker, fiscal representative, or legal advisor unless expressly agreed in writing.

You agree to:

You must be at least 18 years old.

You must not:

You retain ownership of your data.

You grant Astrovia a limited, non-exclusive licence to use your data solely to provide, operate, and improve the Services.

All platform software, designs, trademarks, and content are owned by Astrovia or its licensors and are protected by law.

To the maximum extent permitted by law:

Nothing in these Terms limits liability where such limitation is prohibited by law.

You agree to indemnify Astrovia against claims arising from your use of the Services, data provided, or breach of these Terms.

Astrovia may suspend or terminate access for breach or risk. Upon termination, your licence to use the Services ends.

These Terms are governed by the laws of Victoria, Australia. Courts of Victoria have exclusive jurisdiction.

We may update these Terms. Continued use constitutes acceptance of the updated Terms.

Built for finance and compliance teams. Audit-ready by default.

Astrovia is designed to meet the security, governance, and operational standards required by high-growth and enterprise eCommerce businesses operating globally.

We focus on transparency, control, and defensible compliance.

No system is completely immune to risk, but security is built into Astrovia at every layer.

Designed for governance.

Astrovia complies with global data protection principles, including:

Customer data is:

Astrovia acts as a data processor when handling customer data on behalf of merchants.

Astrovia integrates with trusted third-party platforms including:

Each integration is scoped to minimum required access.

Astrovia provides software and managed coordination tools only.

Astrovia does not act as a licensed tax agent, customs broker, fiscal representative, or legal advisor unless explicitly agreed in writing.

All outputs are informational and merchants remain responsible for final filings, classifications, and regulatory compliance.

For security or compliance enquiries: hello@astrovia.io